Cassandra or Oracle?

April 14, 2009

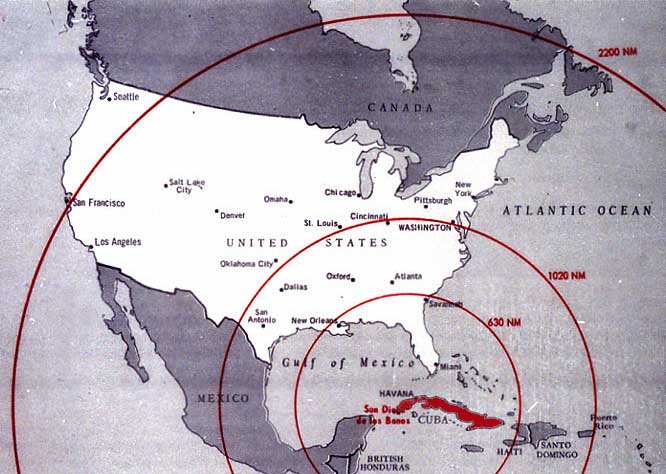

My last email noted that President Obama's speech "committing America to seek a world free of nuclear weapons, was about as close to a miracle as such a speech might come," but concluded with the caveat, "Let us not repeat the mistake of twenty years ago when a similar miracle turned to dust because the public lost interest, mistakenly believing the problem was solved."

My concern was warranted, but misplaced since even this momentous pronouncement failed to attract public attention. Reflecting the public's priorities, media coverage focused on other parts of Obama's speech, so his initiative is unlikely to attract the support it will need to succeed -- unless people like us can move this issue higher on society's priority list.

The momentous part of the speech was probably neglected because conventional wisdom holds that the nuclear threat died with the Cold War. The current economic meltdown demonstrates the immense price that society can pay when conventional wisdom ignores clear warning signs. Warren Buffett is the second richest man in the world and so revered for his financial wisdom that he is often called the Oracle of Omaha. Yet, conventional wisdom ignored his 2002 warning that "derivatives and the trading activities that go with them ... [are] time bombs, both for the parties that deal in them and the economic system." Instead, public appetite for illusory yields created an astounding $600 trillion derivatives market. Only later would society come to see the wisdom in Buffett's prescient warning that "derivatives are financial weapons of mass destruction, carrying dangers that, while now latent, are potentially lethal."

Four years earlier, in 1998, DowJones Financial News had a headline, "Buffett turns Cassandra over catastrophe bonds," when he warned that disaster awaited those who invested in those related financial instruments. Even the Oracle of Omaha can be seen as a Cassandra when his warnings contradict conventional wisdom.

The immense cost that we are all now paying as a result of society ignoring Buffett and other so-called Cassandras pales in comparison with what society will suffer if it continues to neglect the risk posed by nuclear weapons. As evidenced by its lack of response to Obama's miraculous statement, the media will be of little help until this issue becomes a higher societal priority. That is understandable since the mass media, by definition, requires a mass audience.

For that reason, I hope you will continue to act as an oracle, even though you risk being seen as a Cassandra*, by bringing this issue up as frequently as possible with as many people as possible. One way to do that is to share this email with others who might be interested and encourage them to sign up on our web site at http://nuclearrisk.org to automatically receive these updates. If enough of us do that, not only can we avert catastrophe, but we can start transforming the world into one we can be proud to leave to future generations.

Thanks very much.

Martin

================================

Martin Hellman

Member, National Academy of Engineering

Professor Emeritus of Electrical Engineering

Stanford University

* Cassandra is seen negatively by most people -- a madwoman, constantly foretelling doom. But that picture misses a critically important point: Her predictions were always right! Her seeming madness was, in actuality, her unceasing attempts to prevent catastrophic events that could have been avoided if people had dropped their disbelief. In Greek mythology, Apollo blessed Cassandra with the ability to see the future but, when she spurned his advances, cursed her by making no one believe her predictions. In one very apt example, Cassandra knew that Troy would be destroyed if the the wooden horse was taken into the city, but no one would listen. The Trojans had been deceived by Sinon (a Greek who pretended that he had been deserted by his countrymen and now was a friend of Troy) into believing that the horse was an offering to Athena that would make Troy impregnable. After the horse was brought into the city, Sinon let out the hidden Greek warriors, and Troy was destroyed. Both the Trojan horse and nuclear weapons were supposed to make their possessors invulnerable, but both contain the seeds of their complete destruction. So, if we are portrayed as modern day Cassandras, we might even take it as a compliment. While we need to be more effective than her in communicating our concerns, fortunately we have tools, such as the Internet and email, that she did not.

References:

The portion of Warren Buffett's 2002 letter relating to derivatives:

http://www.tilsonfunds.com/BuffettWorries.pdf.

Buffett's entire letter:

http://www.berkshirehathaway.com/letters/2002pdf.pdf.

In January 2008, just months before the financial meltdown began in

earnest, Business Week Chicago's headline called Janet Tavakoli "The

Cassandra of Credit Derivatives." Buffett has a different take and

said, "Janet Tavakoli should have been listened to much more carefully

in the past ... and will be in the future." The article is at

http://www.businessweek.com/bwdaily/dnflash/content/jan2008/db20080128_934507.htm.

As head of the Commodity Futures Trading Commission (CFTC), Brooksley

Born recognized the need to regulate derivatives, but was blocked from

doing so. As reported in the March/April 2009 issue of Stanford's

alumni magazine. "Ultimately, Greenspan and the other regulators

foiled Born's efforts, and Congress took the extraordinary step of

enacting legislation that prohibited her agency from taking any

action." The article is at:

http://www.stanfordalumni.org/news/magazine/2009/marapr/features/born.html.

In the Washington Monthly's October 1994 cover story, Senator Byron

Dorgan wrote extensively about the danger derivatives posed: "here's

the real kicker: Because the key players are federally insured banks,

every taxpayer in the country is on the line. ... What is surprising is

that the Office of the Comptroller of the Currency (OCC) and the

Federal Reserve agree, too, that legislative reform is unnecessary.

'As far as the Federal Reserve Board is concerned,' Chairman Alan

Greenspan testified in May, 'we believe that we are ahead of the curve

on this issue as best one can get.'" At the time Dorgan wrote this, he

noted that "derivatives were now a $35 trillion--that's right,

trillion--worldwide market." By 2008, they had mushroomed to a $600

trillion market. Dorgan's article is at:

http://findarticles.com/p/articles/mi_m1316/is_n10_v26/ai_15818783/.

Archives of earlier emails and other resources are at

http://nuclearrisk.org/resources.php.

To send a comment, change your email address, or unsubscribe please send me a message at ___ (address was deleted from web version of this email to avoid spam).